A PPO is a type o insurance that lets you see a doctor, hospital in network, and out of network. However, the plan can cost more than an HMO, and your out-of-pocket costs are higher. A PPO may be right for you depending on your needs and your budget. A PPO has many benefits.

Flexibility is one the greatest advantages of a PPO. PPO networks are large and can be found almost anywhere. This means you can find the best doctors, or medical care in your community. You may also find that the PPO network makes it easier to pay for services in your area.

A PPO gives you the option to choose your primary doctor. Sometimes, you won't need to have a referral from your doctor in order to see a specialist. You will need to refer a specialist if you don't have a PCP referral. However, you will pay more if you see a specialist with a referral. It is also important to note that you may have to pay a copay, or a fixed dollar amount, for certain healthcare services.

You may be able to reduce the cost of this treatment by calling your insurer before you see an outside-of–network provider. You can avoid having your claim denied by calling the insurance company.

With a PPO you can choose any provider from the network. However, you will still need to pay for care that you receive outside the network. Although the insurance companies and medical providers often agree to lower their usual rates for the services, you can still pay a higher price if you choose to use an out-of-network provider.

A PPO has another advantage: your doctor and other medical professionals are able to negotiate rates and schedules with health facilities. A PPO will give you more choices for testing and lab locations. As a result, you can get the care you need, even if you're traveling or away from home.

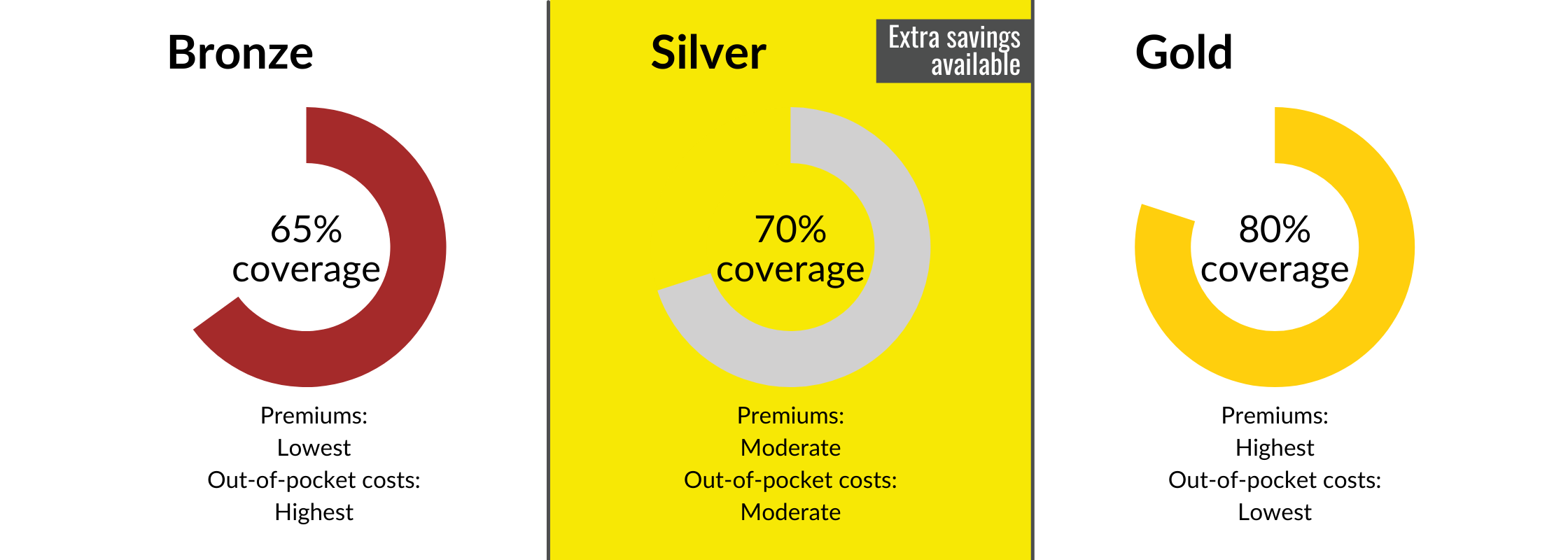

Other factors that you should consider when selecting a PPO include deductibles and copays. Your deductibles are the annual fixed amount you pay before your coverage begins. Typically, the first $1,000 of your costs are covered. Your insurance company will pay the remainder. Copays are fixed dollar amounts you pay each time you have a visit to a provider. Depending on which plan you have, you might also need to pay for birth control and tonsillectomies. The pharmacy can be paid for by you, but your insurance company will determine what prescriptions are covered.

PPO health insurance policies are an excellent choice for those who self-manage their medical care. People who frequently travel and want to have the option of seeing any healthcare provider can opt for this type of insurance. It all comes down to your individual needs and budget.