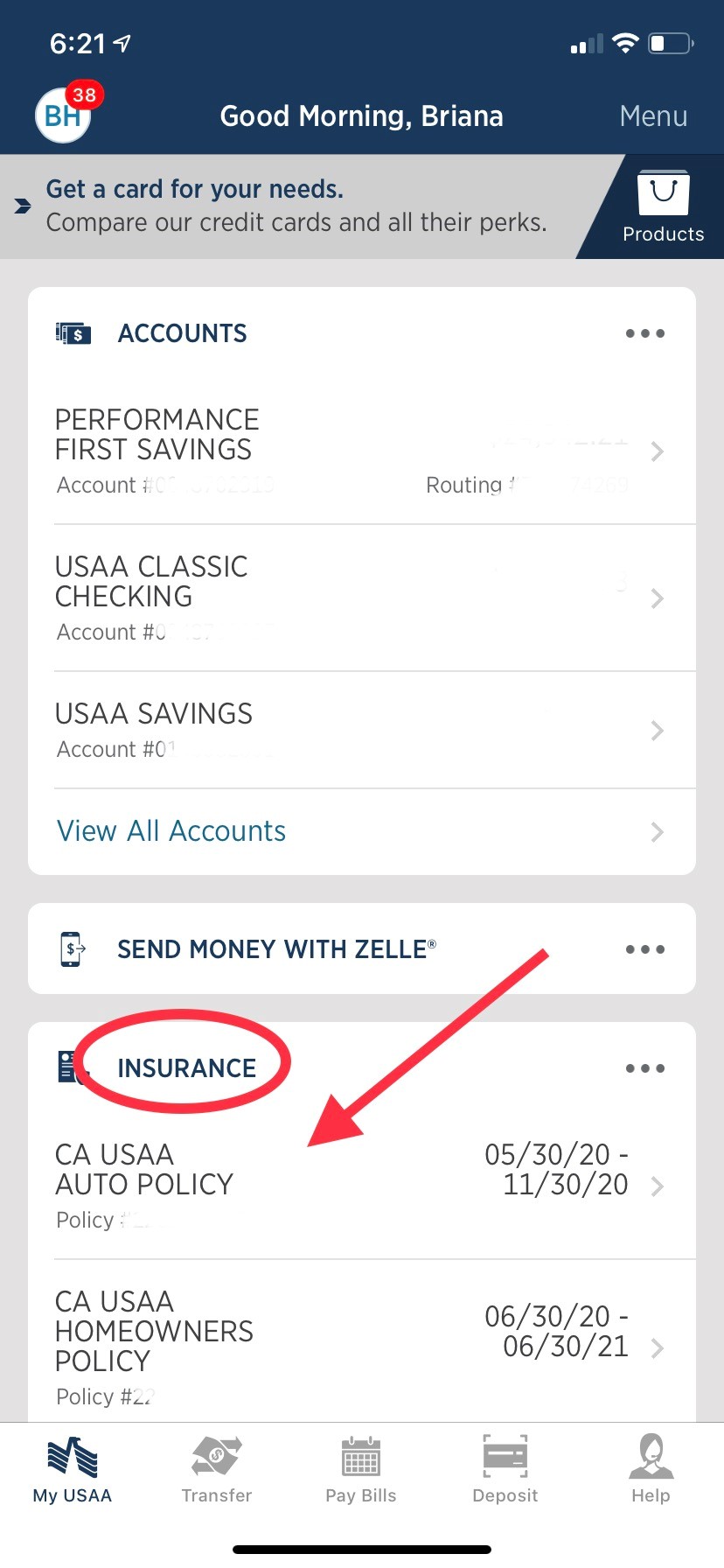

When you are looking to purchase a home in California it is important to research the state insurance laws. Also, find a policy which fits within your budget. In the event that something should go wrong, your investment will be protected. However, figuring out the best home insurance in california can be daunting and time-consuming, especially if you're new to the state.

California Homeowners Insurance: Leading Companies that Offer the Best Coverage

The best home insurance companies will offer you a range of options for coverage including earthquake, flood and wildfire protection. It should also enjoy a solid reputation for providing excellent customer service.

Get the Best Rate. Cost is a major factor in determining the homeowner's insurance rate. Companies will look at a range of factors to determine a fair price. These include the type of house, the chosen deductible and the claims history of the customer.

California Online Quote Tools: Get the Best Homeowners’ Insurance

A number of California's best home insurance providers have their own website where you can easily compare prices and policies. These sites typically feature user-friendly online tools to help you determine the best coverage for your situation. You can even use these websites to shop for discounts and save money.

The majority of homeowners are inclined to shop for the lowest rate when shopping for a brand new policy. It is a wise idea. You can request quotes for multiple insurance companies using many of these online tools. This is especially helpful if you live in a large city, where getting an online quote can be a hassle.

Californians can get quotes by calling or emailing an insurance agent, but this may not be easy for them to do since most of the insurers in California still require you to visit an office in person.

Allstate has the lowest home insurance rates in California. They offer a standard policy that includes $300,000.00 in dwelling and liabilities coverage, a $1000 deductible and a 20% reduction for bundling your home and auto policies. These rates are $612 below the statewide average.

Allstate offers a variety of coverage options including earthquake, water damage, and flood. In addition, they offer a wide variety of discounts, such as 10% for new customers and a 25% discount on bundled policies.

Chubb: This is a top-tier insurer that offers robust insurance for high-value homes and other valuable assets. They offer a wide variety of add-on coverages, like extended replacement value and personal property insurance, as well a high level of customer service.

Progressive: A leading home insurance provider, Progressive is an excellent choice for Californians who need a comprehensive home insurance policy at an affordable price. They are also a highly reputable company that has excellent customer service and low complaint ratings from the NAIC.

There are many different home insurance providers in California. It is important to shop around and find the best one for you. Companies with a good reputation offer quality coverage at a reasonable price. They also provide excellent customer service. It should be easy to navigate, have a quick and convenient claim process, and offer a friendly customer service team that is available to answer any questions you may have.