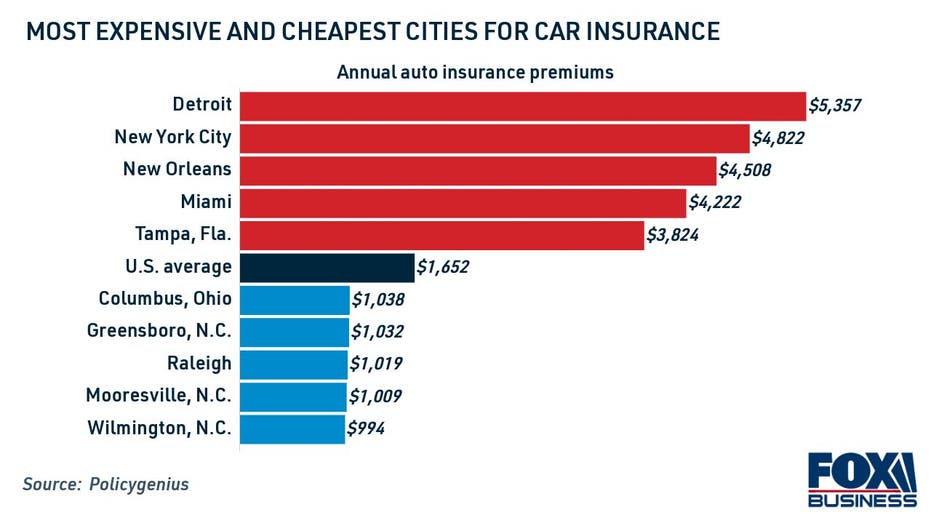

Your car is an expensive asset, so you must protect it. That's why it's a good idea to shop around for baltimore car insurance to make sure you're getting the best coverage at the lowest price possible. How can you tell which company is the best?

Take a look at some of the factors which can influence your Baltimore car insurance rate.

Your age and driving history are two factors that affect the cost of your car insurance. You can also get a discount if you live in a particular state or city.

Baltimore car insurance can be reduced in many ways. You can find some of these discounts easily while others will require a little more work.

The best way to get a discount is to pay less for your policy. Below is a list with some of your most popular options for saving money.

Safe Driver Program

Maryland law requires that insurance companies give a 20% reduction to drivers without tickets or accidents in their records, who have held their licenses for three consecutive years. This discount is available by completing the safe driving course.

Telematics

You can enroll in a telematics service if you own a smartphone. This allows insurance companies to track your driving behavior. It will cost you a fee each month, but the benefits can outweigh it.

Get your auto and home insurance from the same company

You can save 15% by bundling your home and car insurance. This is especially true if you're a student or renter.

Ask about multi-car discounts

Another way to lower your premium is to add more than one car to your policy. You could qualify for a discounted rate if you have more than one car. If your cars are of different make and model, you might even receive additional discounts.

Your Credit Score Can Affect Your Rates

Insurance costs will increase if your credit is bad. Baltimore drivers who have excellent credit are able to save as much as 14 percent in comparison with those with poor or average credit.

The best way to find out how your credit will impact your rates is to speak with an insurance expert and shop around for quotes. When you are able to determine what you will be able to afford, it is easier to make an informed choice about the company and coverage that you should choose.

Your driving record can also have a big impact on your Baltimore car insurance rate. Those with clean records typically pay less than those with speeding tickets or other violations, and it's best to keep your record clean as much as possible to secure the lowest rates.

Baltimore rates are also affected by the car you drive. In general, sports cars and luxury vehicles are more likely to be involved in accidents and thefts, which can drive up your car insurance costs.