Many homeowners insurers claim to have the best rates in the business. It is important to find a company that offers the coverage you need at a price you can afford. This can be a difficult task, however. Here are some tips to help you get the best deal.

Look for homeowners insurance policies that include a replacement cost benefit. This is an essential part of any policy. It protects your home in case of fire or natural catastrophe. Many insurers offer discounts on installing hurricane shutters and upgrading your electrical system.

A deductible should be something you can afford. A deductible is a portion of your home's insurance premium that you pay outright before coverage kicks in. If your deductible is $15,000, you will only be responsible for the amount if you file any claim. You should check your policy at least once per year to ensure you have sufficient coverage.

There are several companies you can choose from if you are looking for the best Illinois homeowners coverage. Allstate, Travelers, Progressive and USAA are all well regarded. These companies are known for their excellent customer service and wide range of coverage options.

It is a large investment and you do not want to make mistakes. Insurance is essential to protect your investment. While it isn’t required in Illinois it is recommended. There are many types of coverage that can be added to, such as flood, earthquakes, identity theft and water backup.

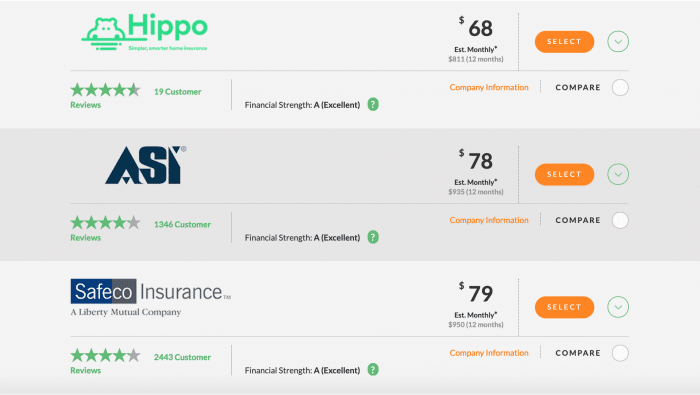

MoneyGeek's list of top home insurance companies in Illinois might be a good place to start if you are looking for a new policy. Website compares many home insurance providers and evaluates their coverage.

Finding the best homeowners insurance Illinois can seem difficult. Several factors affect the cost, such as the age of your home, crime rates, and the area in which you live. However, having a high credit rating can significantly lower your costs.

Allstate is the best option for Illinois home insurance. The average policy costs $1,067 per annum. Another option is the bundled-auto-and-home plan offered by the State Farm. The company has several offices across the state. It is a well-known name, but it has been in existence since 1864.

Other notable insurance offerings include those from Liberty Mutual and USAA. Both companies are active in the communities they serve and both have AM Best A++ ratings for financial strength. These companies offer excellent home and auto insurance that will allow you to save money while still getting the best coverage.

MoneyGeek has a handy homeowners insurance calculator. The Illinois homeowner's insurance comparison table will show you the most affordable insurance for homeowners.