South Carolina homeowners insurance will help protect your home from a variety of threats. You need homeowners insurance to protect your loved ones from any unexpected disasters.

Homeowners Insurance In SC: Find the Best Homeowners Insurance

Know what you're buying when you buy homeowners insurance. It's important to have a policy which covers your home as well as any belongings.

Allstate is the cheapest home insurance provider in South Carolina. USAA was second, Progressive third, State Farm fourth.

Many top companies offer additional discounts to help you reduce your premiums. There are discounts available for those who have not made a claim, or group their policies with others in the family.

If you're considering an auto and homeowners insurance policy from the same company, look for a discount that could save you even more. In South Carolina, a home and auto package is the most popular. However, you can find discounts if you look around.

Homeowners Insurance Costs in SC

It is vital to compare rates from as many companies as possible. This will allow you to find the best possible coverage that fits your needs and budget.

Find the best home insurance rates in SC

In South Carolina, you can get the cheapest homeowners' insurance by considering your location, your credit rating and the age of home. Insurance costs will generally be higher for neighborhoods with higher rates of crime.

Insurance costs will be higher for homeowners with dangerous dog breeds. Some companies refuse to cover certain dog breeds because they are considered high-risk.

Your location in SC

The proximity of South Carolina to the Atlantic Coast means it's prone to tropical storms and hurricanes, as well as flooding from rain and ice melt. If you're in a low-lying area, you should consider purchasing flood coverage, which isn't included in standard homeowners insurance policies.

How to Choose the Best Home insurance in SC

To find the best homeowners insurance in South Carolina, look for a company that has an easy quote process and a variety of discounts. It must also be financially strong so you are confident that your claim will be paid if there is a problem with your property.

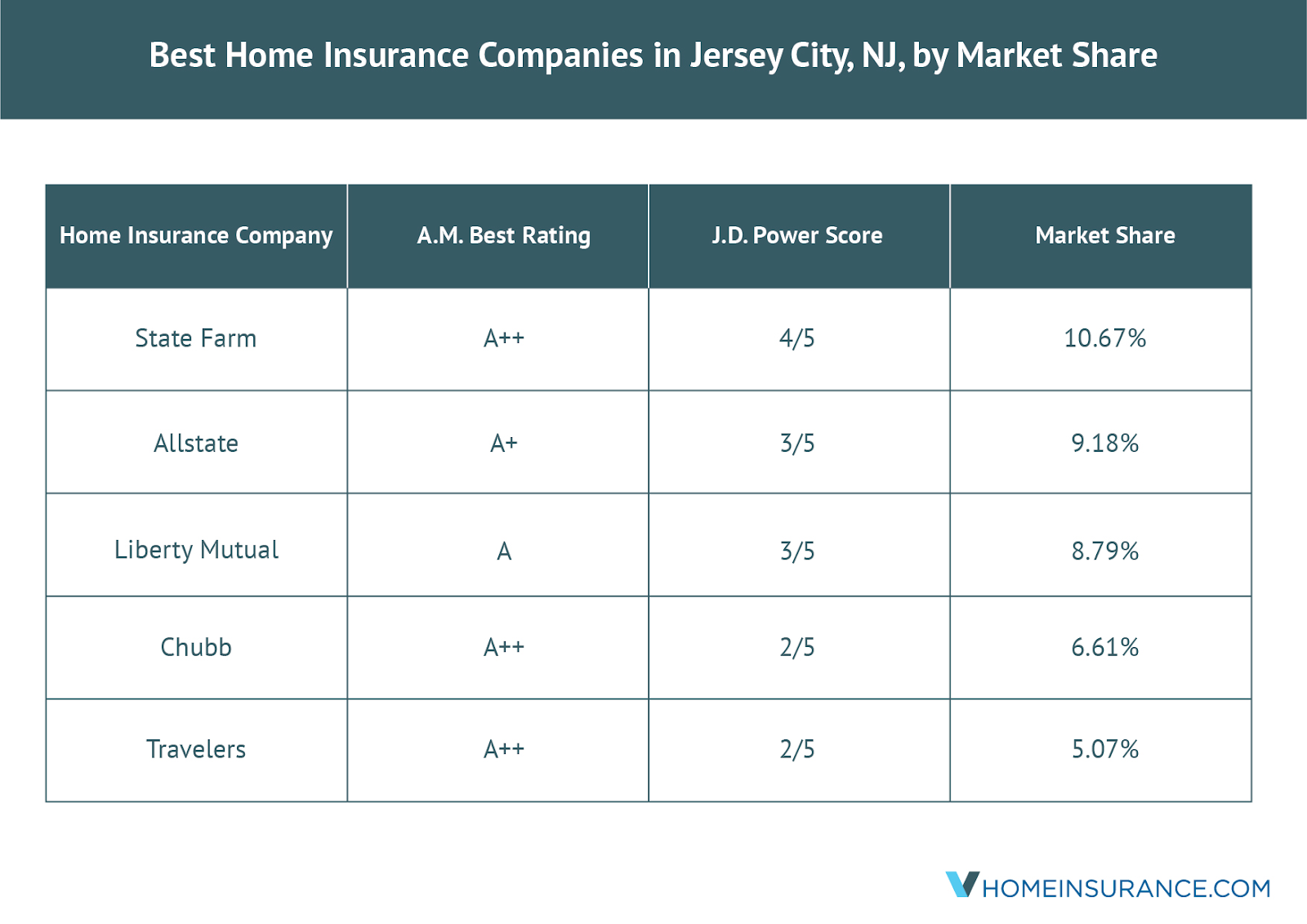

Check whether the company has an excellent financial rating, and that there are plenty of positive customer reviews. These ratings come from organizations like Standard & Poor's and AM Best.

Your deductible. The deductible affects the cost of your insurance, so increasing your deductible can help you save money.